October Property Market Wrap

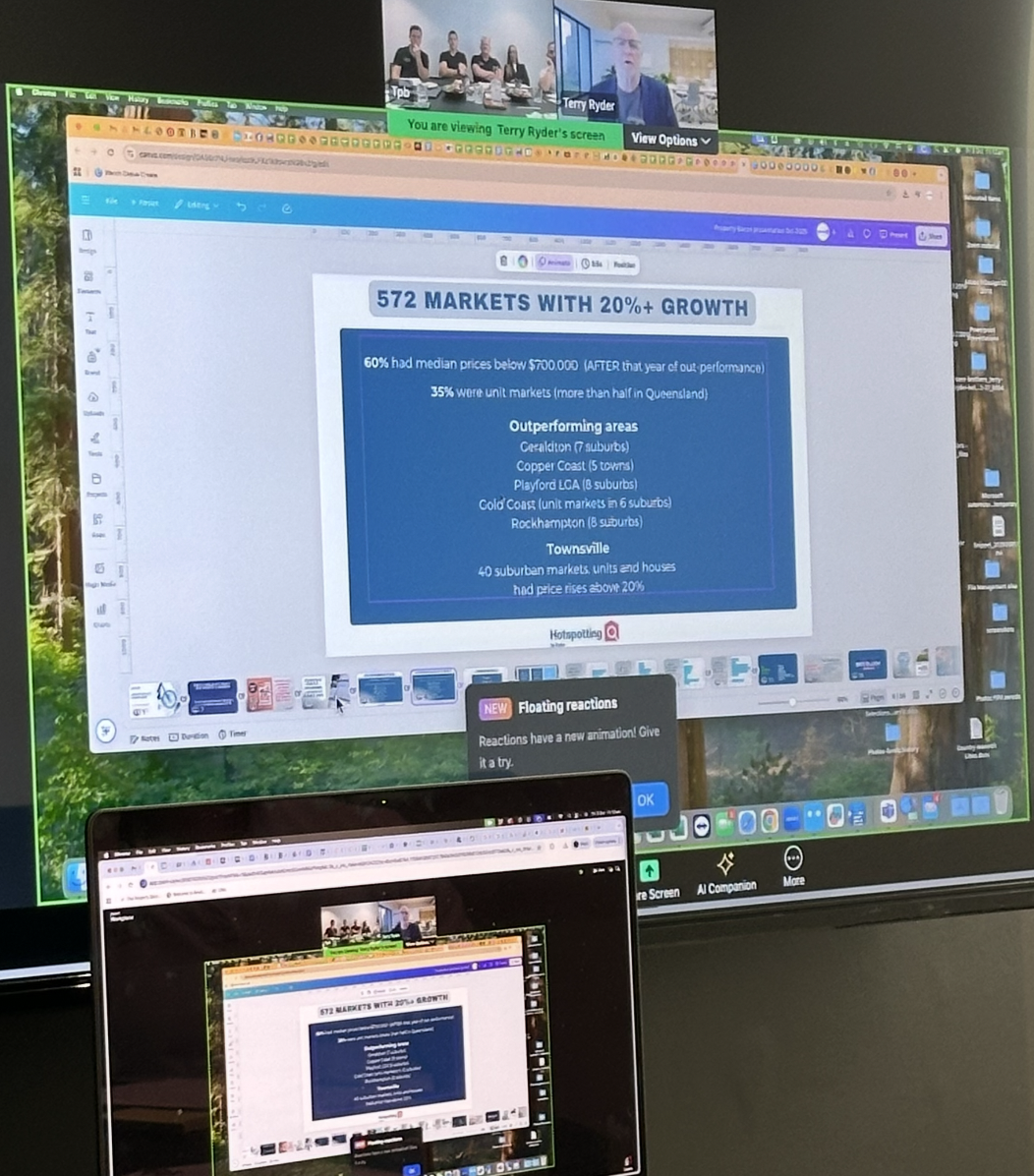

We kicked off the month with a fantastic team session led by Terry Ryder from Hotspotting, who shared valuable insights into the current state of the property market, the long-term impact of the Olympics, and the growth corridors expected to benefit most in the years ahead. It was an incredible opportunity for our team to deepen our understanding of the key drivers shaping the property landscape, knowledge we’re already putting to work for our clients.

Across the board, buyer activity has remained strong, with noticeable momentum returning to prestige and lifestyle markets. The recent wave of first-home buyers entering the market has certainly given the sub $1million section of the market a boost, though the full impacts are yet to be seen.

Here’s a quick snapshot from the team across the region:

Jason’s Update

Sunshine Coast, Noosa & Gold Coast

October has been a strong month across all three regions.

On the Sunshine Coast and in Noosa, demand remains steady, especially from owner-occupiers seeking lifestyle homes. We’re currently assisting both investors and locals finding it tough to secure their ideal home in a competitive market, with interstate relocations and migration activity still very much alive.

On the Gold Coast, the market is running hot, even in the high-end prestige sector. We’re currently working with new clients searching in Sanctuary Cove & Hope Island. This is a unique market with great lifestyle appeal and some great properties on offer for both domestic and international buyers.

Our networks and long-standing agent relationships continue to give our clients early and often exclusive access to listings a clear advantage in such competitive markets. We’re also keeping a close eye on changes to foreign investment rules, which are shifting regularly and impacting international buyer activity. Staying ahead of these updates ensures we can guide our clients through every step with confidence.

Nick’s Update

The Property Baron Brisbane

In Brisbane, our team continues to support a wide range of buyers, from first-home buyers to seasoned investors.

We have been having more conversations than ever with first-home buyers, helping them explore practical ways to enter the market , whether that means buying and moving in, or purchasing an investment property and renting elsewhere to get a foothold on the property ladder.

This month has also been one of the busiest for industry connection and collaboration. We’ve met more industry colleagues than ever, and the sentiment is consistent across the board, buyers are ready to move quickly when the right opportunity arises. As buyers agents, we’ve been guiding clients through that momentum, helping them navigate fast-moving conditions to make the right decisions with confidence, leaving emotions out of the transaction.

Our Brisbane team covers inner Brisbane, the north side, and the fast-growing Logan corridor, where Joel brings deep local knowledge and connections.

You can download our latest investor report and explore more resources here: https://www.thepropertybaron.com.au/category/free-guides-reports/

Hugo’s Update

The Property Baron Invest

At The Property Baron Invest, the focus this month has been on helping clients identify high-performing investment opportunities in South-East Queensland and regional growth corridors.

We’ve been analysing emerging pockets that show strong infrastructure spend, population growth, and low vacancy rates, giving investors a strategic advantage in building long-term, resilient portfolios.

We’re seeing extreme demand in the sub-$750k markets, with tight supply and properties selling within days in some of these markets, as both entry-level investors and first home buyers compete for affordable homes.

Our conversations with both new and returning clients have reflected a growing appetite for diversified investment strategies particularly those balancing capital growth and cash flow through a mix of residential and dual-income properties.

We’re also working closely with our finance and advisory partners to help clients structure purchases efficiently, especially in light of recent lending policy shifts and interest rate trends.

If you’re looking to grow or review your investment portfolio, you can download our latest report or book a Discovery Call to discuss tailored strategies with the TPB Invest team.

Industry News – October

Taxes Remain the Biggest Concern

The continual increase in property-related taxes and levies is putting pressure on the construction and investment sectors.

The latest Procore/Property Council survey shows that concerns around taxation have doubled, with 32% of respondents listing it as the top issue for state governments — the highest on record. In Victoria, that number climbs to 63%.

Property Council Chief Executive Mike Zorbas says:

“New home buyers are being slugged with a shocking tax burden. Around 30% of a new home’s purchase price goes to government taxes, only a fraction of which ends up as community infrastructure.”

Approvals Remain Stable

Despite a small 2.9% dip in August, housing approvals have remained steady nationwide, down just 0.9% year-on-year. This stability highlights the resilience of Australia’s housing market.

HIA Senior Economist Tom Devitt attributes this to:

- Declining interest rates

- Strong population growth

- Tight labour markets

- Recovering household incomes

Queensland, Western Australia, and South Australia continue to lead the nation in approvals, with medium and higher-density housing expected to play a bigger role in meeting future housing targets.

Get in touch